In response to the Coronavirus (COVID-19) pandemic, the Treasury and IRS issued new guidance that calls for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Is the tax deadline going to be extended again in 2021?

Usually, the IRS requires you to file taxes for up to the past six years of delinquency, though they encourage taxpayers to file all missing tax returns if possible. The IRS requires you to go back and file your last six years of tax returns to get in their good graces. How many years can you go without filing taxes? Can I still efile my 2016 taxes electronically in 2020?Īnswer: Yes, electronically filed tax returns are accepted until November. Filing for the extension wipes out the penalty. If you’re more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

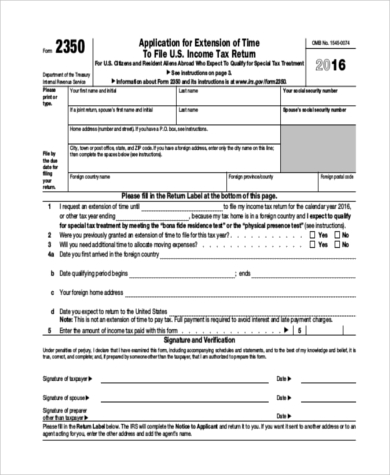

Late-filing penalties can mount up at a rate of 5% of the amount due with your return for each month that you’re late. What if I can’t get my taxes done by the filing deadline? If you request a tax extension by May 17, you can have until October 15 to file your taxes. If you need to make an estimated tax payment for the first quarter, that payment was due on April 15, though. You might be interested: How Much Is Tax In Kansas? (Perfect answer) How long do I have to pay my taxes 2021? With the postponement, individual taxpayers who are due a refund may now file their return for the 2016 tax year no later than May 17, 2021, to claim their money. Yee today announced an extension to May 17, 2021, for individual California taxpayers to claim a refund for tax year 2016. You’ll receive an electronic acknowledgment once you complete the transaction. You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You can file a tax extension online or via mail by following these steps:Ĭan I still file an extension for 2016 taxes?

To qualify for a tax extension, you must file the appropriate form by the standard tax filing deadline of Ap(or April 19, 2016, if you live in Maine or Massachusetts). The tax extension deadline is the regular tax deadline.If taxpayers do not file a return within three years, the money becomes property of the U.S.

The law provides a three-year window of opportunity to claim a refund. For 2016 tax returns, the normal April 15 deadline to claim a refund has also been extended to July 15, 2020.

0 kommentar(er)

0 kommentar(er)